Overview

- Malleability Fixes

- Linear scaling of sighash operations

- Increased security for multisig via pay-to-script-hash (P2SH)

- Script versioning

- Reducing UTXO growth

- Efficiency gains when not verifying signatures

- Block capacity/size increase

- Moving towards a single combined block limit

- Update 2016-10-19

- Update 2020-06-23

The Segregated Witness soft-fork (segwit) includes a wide range of features, many of which are highly technical. This page summarises some of the benefits of those features.

Malleability Fixes

Bitcoin transactions are identified by a 64-digit hexadecimal hash called a transaction identifier (txid) which is based on both the coins being spent and on who will be able to spend the results of the transaction.

Unfortunately, the way the txid is calculated allows anyone to make small modifications to the transaction that will not change its meaning, but will change the txid. This is called third-party malleability. BIP 62 (“dealing with malleability”) attempted to address these issues in a piecemeal manner, but was too complicated to implement as consensus checks and has been withdrawn.

For example, you could submit a transaction with txid ef74…c309 to the network, but instead find that a third-party, such as a node on the network relaying your transaction, or the miner who includes your transaction in a block, modifies the transaction slightly, resulting in your transaction still spending the same coins and paying the same addresses, but being confirmed under the completely different txid 683f…8bfa instead.

More generally, if one or more of the signers of the transaction revise their signatures then the transaction remains valid and pays the same amounts to the same addresses, but the txid changes completely because it incorporates the signatures. The general case of changes to signature data (but not the outputs or choice of inputs) modifying the transaction is called scriptSig malleability.

Segwit prevents third-party and scriptSig malleability by allowing Bitcoin users to move the malleable parts of the transaction into the transaction witness, and segregating that witness so that changes to the witness does not affect calculation of the txid.

Who benefits?

-

Wallet authors tracking spent bitcoins: it’s easiest to monitor the status of your own outgoing transactions by simply looking them up by txid. But in a system with third-party malleability, wallets must implement extra code to be able to deal with changed txids.

-

Anyone spending unconfirmed transactions: if Alice pays Bob in transaction 1, Bob uses that payment to pay Charlie in transaction 2, and then Alice’s payment gets malleated and confirmed with a different txid, then transaction 2 is now invalid and Charlie has not been paid. If Bob is trustworthy, he will reissue the payment to Charlie; but if he isn’t, he can simply keep those bitcoins for himself.

-

The Lightning Network: with third-party and scriptSig malleability fixed, the Lightning Network is less complicated to implement and significantly more efficient in its use of space on the blockchain. With scriptSig malleability removed, it also becomes possible to run lightweight Lightning clients that outsource monitoring the blockchain, instead of each Lightning client needing to also be a full Bitcoin node.

-

Anyone using the block chain: smart contracts today, such as micropayment channels, and anticipated new smart contracts, become less complicated to design, understand, and monitor.

Note: segwit transactions only avoid malleability if all their inputs are segwit spends (either directly, or via a backwards compatible segwit P2SH address).

Further information

- Bitcoin Wiki on Malleability

- Coin Telegraph article on 2015 Malleability attack

- Bitcoin Magazine article on 2015 Malleability attack

- “Overview of BIPs necessary for Lightning” transcript

- BIP 62

- BIP 140 – alternative approach to malleability fixes

- Stack exchange answer regarding 683f…8bfa transaction

Linear scaling of sighash operations

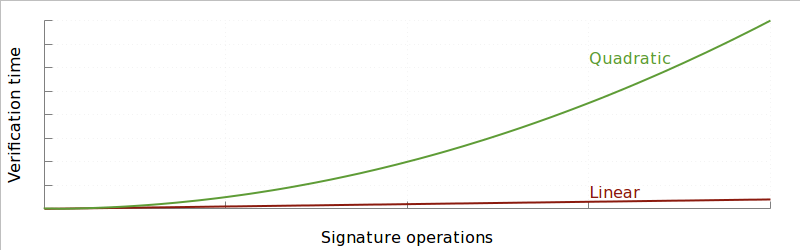

A major problem with simple approaches to increasing the Bitcoin blocksize is that for certain transactions, signature-hashing scales quadratically rather than linearly.

In essence, doubling the size of a transaction can double both the number of signature operations, and the amount of data that has to be hashed for each of those signatures to be verified. This has been seen in the wild, where an individual block required 25 seconds to validate, and maliciously designed transactions could take over 3 minutes.

Segwit resolves this by changing the calculation of the transaction hash for signatures so that each byte of a transaction only needs to be hashed at most twice. This provides the same functionality more efficiently, so that large transactions can still be generated without running into problems due to signature hashing, even if they are generated maliciously or much larger blocks (and therefore larger transactions) are supported.

Who benefits?

Removing the quadratic scaling of hashed data for verifying signatures makes increasing the block size safer. Doing that without also limiting transaction sizes allows Bitcoin to continue to support payments that go to or come from large groups, such as payments of mining rewards or crowdfunding services.

The modified hash only applies to signature operations initiated from witness data, so signature operations from the base block will continue to require lower limits.

Further information

- BIP 143

- Blog post by Rusty Russell on the 25s transaction

- CVE 2013-2292 on Bitcoin wiki

- Proposal to limit transactions to 100kB

- Bitcoin Classic commit on 0.11.2 branch adding additional consensus limit on sighash bytes

Increased security for multisig via pay-to-script-hash (P2SH)

Multisig payments currently use P2SH which is secured by the 160-bit HASH160 algorithm (RIPEMD of SHA256). However, if one of the signers wishes to steal all the funds, they can find a collision between a valid address as part of a multisig script and a script that simply pays them all the funds with only 80-bits (280) worth of work, which is already within the realm of possibility for an extremely well-resourced attacker. (For comparison, at a sustained 1 exahash/second, the Bitcoin mining network does 80-bits worth of work every two weeks)

Segwit resolves this by using HASH160 only for payments direct to a single public key (where this sort of attack is useless), while using 256-bit SHA256 hashes for payments to a script hash.

Who benefits?

Everyone paying to multisig or smart contracts via segwit benefits from the extra security provided for scripts.

Further information

- Gavin Andresen asking if 80-bit attacks are worth worrying about

- Ethan Heilman describing a cycle finding algorithm

- Rusty Russell calculating costs of performing an attack

- Anthony Towns applying the cycle finding algorithm to exploit transactions

- Gavin Andresen summarising the thread

Script versioning

Changes to Bitcoin’s script allow for both improved security and improved functionality. However, the design of script only allows backwards-compatible (soft-forking) changes to be implemented by replacing one of the ten extra OP_NOP opcodes with a new opcode that can conditionally fail the script, but which otherwise does nothing. This is sufficient for many changes – such as introducing a new signature method or a feature like OP_CLTV, but it is both slightly hacky (for example, OP_CLTV usually has to be accompanied by an OP_DROP) and cannot be used to enable even features as simple as joining two strings.

Segwit resolves this by including a version number for scripts, so that additional opcodes that would have required a hard-fork to be used in non-segwit transactions can instead be supported by simply increasing the script version.

Who benefits?

Easier changes to script opcodes will make advanced scripting in Bitcoin easier. This includes changes such as introducing Schnorr signatures, using key recovery to shrink signature sizes, supporting sidechains, or creating even smarter contracts by using Merklized Abstract Syntax Trees (MAST) and other research-level ideas.

Reducing UTXO growth

The Unspent Transaction Output (UTXO) database is maintained by each validating Bitcoin node in order to determine whether new transactions are valid or fraudulent. For efficient operation of the network, this database needs to be very quick to query and modify, and should ideally be able to fit in main memory (RAM), so keeping the database’s size in bytes as small as possible is valuable.

This becomes more difficult as Bitcoin grows, as each new user must have at least one UTXO entry of their own and will prefer having multiple entries to help improve their privacy and flexibility, or to provide as backing for payment channels or other smart contracts.

Segwit improves the situation here by making signature data, which does not impact the UTXO set size, cost 75% less than data that does impact the UTXO set size. This is expected to encourage users to favour the use of transactions that minimise impact on the UTXO set in order to minimise fees, and to encourage developers to design smart contracts and new features in a way that will also minimise the impact on the UTXO set.

Because segwit is a soft-forking change and does not increase the base blocksize, the worst case growth rate of the UTXO set stays the same.

Who benefits?

Reduced UTXO growth will benefit miners, businesses, and users who run full nodes, which in turn helps maintain the current security of the Bitcoin network as more users enter the system. Users and developers who help minimise the growth of the UTXO set will benefit from lower fees compared to those who ignore the impact of their transactions on UTXO growth.

Further information

Efficiency gains when not verifying signatures

Signatures for historical transactions may be less interesting than signatures for future transactions – for example, Bitcoin Core does not check signatures for transactions prior to the most recent checkpoint by default, and some SPV clients simply don’t check signatures themselves at all, trusting that has already been done by miners or other nodes. At present, however, signature data is an integral part of the transaction and must be present in order to calculate the transaction hash.

Segregating the signature data allows nodes that aren’t interested in signature data to prune it from the disk, or to avoid downloading it in the first place, saving resources.

Who benefits?

As more transactions use segwit addresses, people running pruned or SPV nodes will be able to operate with less bandwidth and disk space.

Block capacity/size increase

Since old nodes will only download the witness-stripped block, they only enforce the 1 MB block size limit rule on that data. New nodes, which understand the full block with witness data, are therefore free to replace this limit with a new one, allowing for larger block sizes. Segregated witness therefore takes advantage of this opportunity to raise the block size limit to nearly 4 MB, and adds a new cost limit to ensure blocks remain balanced in their resource use (this effectively results in an effective limit closer to 1.6 to 2 MB).

Who benefits?

People who run upgraded wallets will be able to take advantage of the increased block size by moving signatures to the witness section of the transaction.

Moving towards a single combined block limit

Currently there are two consensus-enforced limits on blocksize: the block can be no larger than 1MB and, independently, there can be no more than 20,000 signature checks performed across the transactions in the block.

Finding the most profitable set of transactions to include in a block given a single limit is an instance of the knapsack problem, which can be easily solved almost perfectly with a simple greedy algorithm. However adding the second constraint makes finding a good solution very hard in some cases, and this theoretical problem has been exploited in practice to force blocks to be mined at a size well below capacity.

It is not possible to solve this problem without either a hardfork, or substantially decreasing the block size. Since segwit can’t fix the problem, it settles on not making it worse: in particular, rather than introducing an independent limit for the segregated witness data, instead a single limit is applied to the weighted sum of the UTXO data and the witness data, allowing both to be limited simultaneously as a combined entity.

Who benefits?

Ultimately miners will benefit if a future hardfork that changes the block capacity limit to be a single weighted sum of parameters. For example:

50*sigops + 4*basedata + 1*witnessdata < 10M

This lets miners easily and accurately fill blocks while maximising fee income, and that will benefit users by allowing them to more reliably calculate the appropriate fee needed for their transaction to be mined.

Further information

- Knapsack problem

- Sigop attack discussion on bitcointalk in Aug 2015

- Gregory Maxwell on bitcoin-dev on witness limits

- “Validation Cost Metric” transcript

Update 2016-10-19

Earlier versions of this page listed “Compact fraud proofs” as a benefit of segwit. However, as implemented, segwit does not make this any easier: with or without segwit, a future soft-fork enabling compact fraud proofs and the benefits they bring, will need to include its own commitment (eg, in the coinbase transaction), rather than being able to extend the commitment data used by segwit.

The previous text was:

Compact fraud proofs

As the Bitcoin userbase expands, validating the entire blockchain naturally becomes more expensive. To maintain the decentralised, trustless nature of Bitcoin, it is important to allow those who cannot afford to validate the entire blockchain to at least be able to cheaply validate as much of it as they can afford.

Segwit improves the situation here by allowing a future soft-fork to extend the witness structure to include commitment data, which will allow lightweight (SPV) clients to enforce consensus rules such such as the number of bitcoins introduced in a block, the size of a block, and the number of sigops used in a block.

Who benefits?

Fraud proofs allow SPV users to help enforce Bitcoin’s consensus rules, which will potentially greatly increase the security of the Bitcoin network as a whole, as well as reduce the ways in which individual users can be attacked.

These fraud proofs can be added to the witness data structure as part of a future soft-fork, and they’ll help SPV clients enforce the rules even on transactions that don’t make use of the segwit features.

Update 2020-06-23

Earlier versions of this page listed “Signing of input values” as a benefit of segwit. However, as implemented, segwit does not make this safe: with or without segwit, a future soft-fork will be needed to rely on signed input values.

Since the values of each input are signed individually, the apparent fee can be manipulated in deceiving ways. (CVE-2020-14199)

The previous text was:

Signing of input values

When a hardware wallet signs a transaction, it can easily verify the total amount being spent, but can only safely determine the fee by having a full copy of all the input transactions being spent, and must hash each of those to ensure it is not being fed false data. Since individual transactions can be up to 1MB in size, this is not necessarily a cheap operation, even if the transaction being signed is itself quite small.

Segwit resolves this by explicitly hashing the input value. This means that a hardware wallet can simply be given the transaction hash, index, and value (and told what public key was used), and can safely sign the spending transaction, no matter how large or complicated the transaction being spent was.

Who benefits?

Manufacturers and users of hardware wallets are the obvious beneficiaries; however this likely also makes it much easier to safely use Bitcoin in small embedded devices for “Internet of things” applications.

This benefit is only available when spending transactions sent to segwit enabled addresses (or segwit-via-P2SH addresses).

Further information